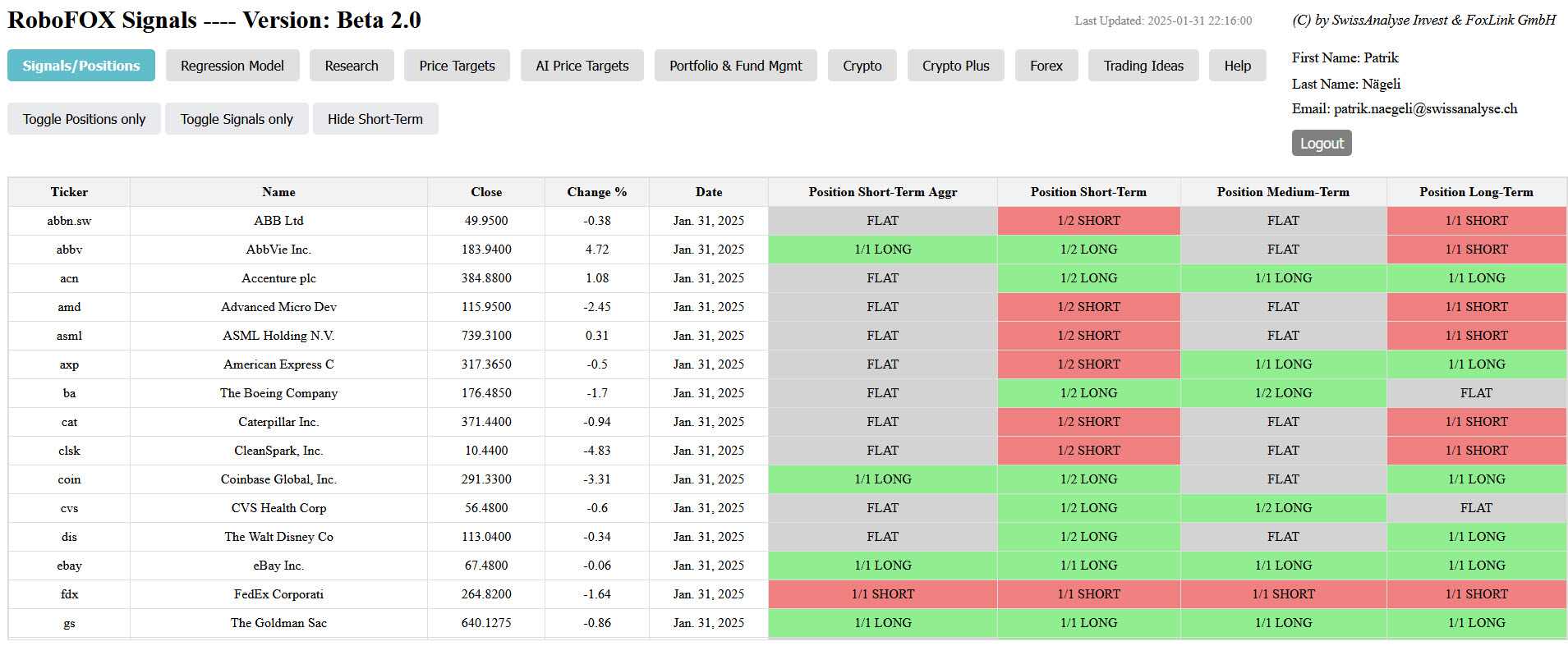

Performance of robofox

Our 4 (5) Portfolios:

We have set up 4 (5) portfolios and

manage them for ourselves at the moment, in future set up funds, etc.:

- RoboFOX SMARTInnovation, Tranches: long only, long & short, long & short Leverage; (BM NDX)

- RoboFOX BIGInnovation, Tranches: long only, long & short, long & short Leverage; (BM NDX)

- RoboFOX Crypto, Tranches: long only, long & short; (Crypto BM)

- RoboFOX DivETF, Tranches: long only (only ETFs); (ETF-BM)

-

BETA RoboFOX Swiss, Tranches: long only; (BM SMI)

PERFORMANCE:

YTD netto, per 26.2.2025:

- RoboFOX SMARTInnovation: +2.74%; long only +2.75%; (BM NDX)

- RoboFOX BIGInnovation: +0.25%; long only +1.88%; with Leverage +8.62%; (BM NDX)

- RoboFOX Crypto: 15.67%; (Crypto BM)

- RoboFOX DivETF: 3.65%; (ETF-BM)

- BETA RoboFOX Swiss: 3.40%; (BM SMI)

Benchmarks (BM):

- SMI: +12.43%

- DAX: +14.49%

- NDX: +0.57%

- "Crypto BM": -20.6% (the performance of our trading cryptos)

-

"ETF-BM": 9.17%

Track-Record of our RoboFOX Portfolios:

Year SMARTInnovation BIGInnovation TECRYPInnovation Crypto DivETF

2018 +20.25% +18.41%

2019 +32.30% +26.12%

2020 +72.54% +47.58%

2021 +38.04% +26.74% +48.34% +10.76%

2022 +53.75% +29.38% +51.45% +174.22% +8.91%

2023 +47.00% +38.42% +60.70% +123.20% +12.31%

2024 +53.00% +46.67% +202.08% +7.43%